Circular Green and ESG Finance

Circular, Green and ESG Finance area of the GREEN Research Centre was established in 2019 with the support of and in collaboration with Intesa Sanpaolo (ISP) Banking Group, specifically through the ISP Innovation Center (ISPIC). Since its inception, the partnership has focused on the relationship between circular economy as a new economic paradigm which supports sustainable transition on one hand and finance as a way for accelerating the transition on the other. The partnership also regularly collaborates with NGOs such as the Ellen MacArthur Foundation and policy bodies such as the UNEP FI (United Nations Environment Programme Finance Initiative) by providing academic input to their initiatives.

The primary areas of research thus far have been:

- The relationship between Circular Economy (CE) and Finance

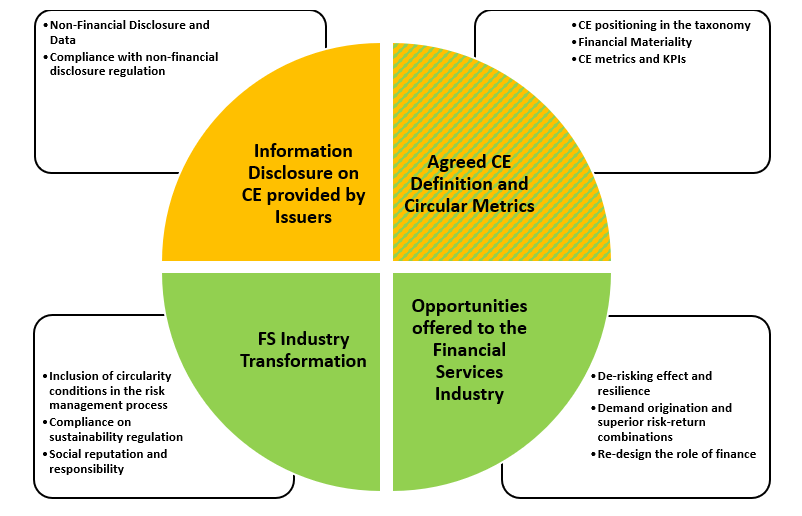

CE as a theme which targets specific ESG issues that cross global socio-economic phenomena and can be linked to specific sustainability outcomes while impacting financial returns. The analysis is conducted within the framework of changing global and EU-specific regulations.

- The relationship between Green Economy (GE) and Finance

Finance as a key actuator of natural capital policies as well as a tackle against climate change and climate risks.

- Transition/ESG Finance

Understanding the pattern of capital flows as a key enabler in the transition towards a more sustainable economy. Research has focused on understanding how adopting more sustainable practices can ensure a greater level of competitiveness in the present volatile geo-political landscape where, for example, virgin raw materials are increasingly becoming a strategic bargaining lever.

The Relationship between Circular Economy and Finance

In 2019, Intesa Sanpaolo and Università Bocconi signed a rolling agreement to collaborate in the field of sustainable finance. The close collaboration with ISPIC has brought into fruition independent academic research on the relationship between CE and Finance. ISPIC has the mission to act as an accelerator for fostering a culture of innovation in the economy with particular attention to Digital Transformation and Circular Economy.

The research projects are organized around 4 pillars that are considered crucial for the sustainable transformation of finance:

Contacts

circular.finance@unibocconi.it

Research Stream 2019-2021

Prof. Claudio Zara, Dr. Luca Bellardini (Phd), Dr. Shyaam Ramkumar (Phd), Research assistants Giacomo Bezzi, Margherita Gobbi, Martina Iannuzzi, Federica Oliva, Guido Roncali.

Publications

- Zara C, Bellardini L, Gobbi M (2023) Circular economy, stock volatility, and resilience to the COVID-19 shock. The Quarterly Journal of Finance 13(2):1-48. doi:10.1142/S2010139223400062. Available as SSRN Working Paper (link).

- Zara C., Ramkumar S. (2022). Circular economy and default risk. Journal of Financial Management, Markets and Institutions, 2250001, 1-24 https://doi.org/10.1142/S2282717X22500013 (link).

- Tellini M., El Khoury C., Zara C., Bellardini L. (2022). La sostenibilità evolve: economia e finanza circolari per un nuovo sviluppo. Bancaria, 2022(4), 17-31 (link).

- Zara C, Iannuzzi M, Ramkumar S (2022) The impact of Circular Economy on Public Equity in Europe. Bancaria - Forum Section, 2022(9):1. Available as SSRN Working Paper (link).

- Zara, C., Bellardini, L., Roncali, G. (2021). Circular economy as a de-risking strategy and driver of superior risk-adjusted returns. A white paper published by the Ellen MacArthur Foundation in collaboration with Bocconi University and Intesa Sanpaolo (link).

- Zara C. (2020). Circular Economy and Finance. Opportunities for the financial services industry. In Pettinaroli A. (editor), Transformative Economies. From the Circular Economy to the Green New Deal, 8-21. Fondazione Giangiacomo Feltrinelli (link).

Events

- Circular finance and business growth, Green Economy Observatory Workshop, 20 May 2021

Research Stream 2022-2025

Prof. Claudio Zara, Dr. Maximilian Göbel (Phd), Dr. Martina Barbaglia (PhD), Research assistants: Giacomo Bezzi, Francesca D’Orazio, Paola Di Rocco, Ylenia Moscheni, Borui Qiu, Aakanksha Srisha.

Publications

Zara C., Bellardini L., Oliva F. (2025). Circular economy, corporate sustainability reporting and equity risk in European markets: First findings. Bancaria - Forum Section, 2025(3). Available as SSRN Working Paper (link)

- Zara C., Bellardini L. (2023). Circular Economy and Finance: Either a straightforward relation or a virtuous loop? In H. Lehtimäki, L. Aarikka-Stenroos, A. Jokinen, P. Jokinen (editors), The Routledge Handbook of Catalysts for a Sustainable Circular Economy. (link to Handbook) (link to Chapter)

Working papers

Akpinar M., Moscheni Y., Zara C. (2025). An applied analytical framework for creating circular shared value in the banking industry. Available as SSRN Working Paper (link).

Zara C., Barbaglia M., Göbel M. (2025). Is non-financial disclosure a mediator of corporate sustainability performance? The case of circular economy and default risk in Europe.

Zara C., Bezzi G. (2025). Does sustainability affect the private equity asset class?

- Zara C., Bellardini L. (2023). Circular Economy, Non-financial Disclosure and Default Risk in European Companies.

- Zara C., Göbel M., Qiu B. (2023). Expanding the Zoo: The Circularity Factor.

Relationships with Policymakers

Participation in the Working Group by UNEP FI (United Nations Environment Programme Finance Initiative) on Circular Economy as an enabler to operationalise the Nexus between Climate Change, Nature and Healthy & Inclusive Economies, which led to the production of the following documents so far:

Guidance on Resource Efficiency and Circular Economy Target Setting – Version 2 (2023) (link).

Circular Economy as an Enabler for Responsible Banking: Leveraging the Nexus between Circularity and Sustainability Impact (2024) (link).

Events

UNEP FI Workshop: Launch of the report on Circular Economy as an Enabler for Responsible Banking, 18 July 2024

- GREEN Workshop: Climate change, local development and financial markets April 14th 2023

Partnership and collaborations